The name and VAT number of the data provider (FI+Business ID).

The 5-character reporting unit code (INT code), which is given to data providers upon application for example FI02345678INT01.

You can select the period after you log on to the programme.

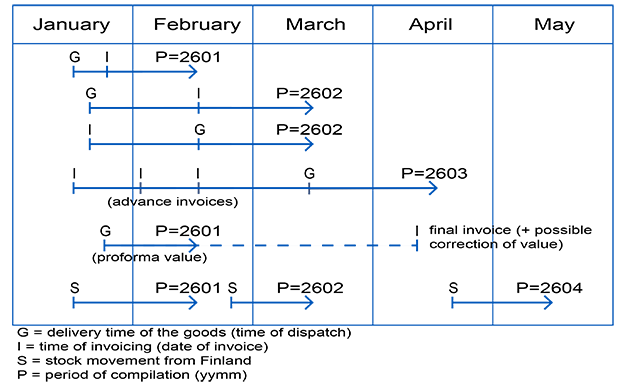

As a rule, the same dispatches as for the corresponding VAT period belong to the period of compilation. Period of compilation refers to the calendar month during which the goods are exported from Finland, provided that the invoicing of the goods has taken place during the month in question or during the preceding months. Goods that are invoiced within the month following the delivery month shall be declared in the statistical declaration of the month indicated by the invoice date. If the invoicing takes place later, the period of compilation is defined according to the month in which the goods were delivered. If no invoice is associated with the goods delivery (e.g. goods supplied free of charge), the statistical period is the calendar month during which the goods have been dispatched.

Deliveries of goods to consignment stocks, merchandise inventories and similar warehouses are declared according to the month of delivery.

Invoicing in several instalments:

- The statistical period of deliveries for construction and similar projects is defined by the month the goods are imported to Finland or exported from Finland.

- Partial deliveries are declared all at once, regardless of when they are invoiced, that is, when all partial deliveries of the goods in question have been sent.

Intrastat period of compilation (+ due date) in 2026

Intrastat Declaration Service provides the Declaration ID. If the declaration is sent as message exchange the customer creates the Declaration ID himself.

The name and VAT number of the agent. The sender of the declaration authorized by the data providing company.

This section is for the declarant's own use. The entered data may be used as identification data for example for retrospective checking. The length and form of the reference depend on the declaration method and are described in the completion instructions and in the instructions for creating ASCII- and CSV-files. The use of the reference is optional.

The trading partner is the buyer or recipient of the goods in the country of destination for the dispatches. Therefore, the trading partner is the company that is the importer of the goods in another EU country. The VAT number of the company is the detail to be collected.

Example 1: The goods and the invoice related to the same customer

A Finnish company FI sells goods to a Swedish company SE, and the goods are delivered to the Swedish company. FI submits an Intrastat declaration for dispatches where the country of destination is SE and the VAT number of the Swedish company is provided as the VAT number of the trading partner.

Example 2: Delivery of goods and the invoice to different EU countries

A Finnish company FI sells goods to a French company FR. The goods are delivered to Italy, to the company IT. FI submits an Intrastat declaration for dispatches in which the country of destination is IT and the VAT number of the Italian company is declared in the Intrastat declaration.

Example 3: Delivery of goods to an EU country and the invoice to a non-member country

A Finnish company FI sells goods to a Swiss company CH. The goods are delivered to Portugal, to the company PT. FI submits an Intrastat declaration for dispatches in which the country of destination is PT and the VAT number of the Portuguese company is declared in the Intrastat declaration.

Example 4: Delivery of goods and invoicing to the same EU country but to different companies

A Finnish company FI sells goods to a Swedish company SE1, and the goods are delivered to the Swedish company SE2. FI submits an Intrastat declaration for dispatches in which the country of destination is SE and the VAT number of the Swedish company SE1 is provided as the VAT number of the trading partner. SE1 declares the intra-Community acquisition in Sweden.

Example 5: Delivery of goods for processing

A Finnish FI company delivers goods for processing under contract to a German company DE. After processing the goods are delivered from Germany to Belgium, where the Finnish company FI sells them to the Belgian company BE. FI submits an Intrastat declaration for dispatches where the country of destination is DE and the VAT number of the German company is provided as the VAT number of the trading partner (transactions type 42).

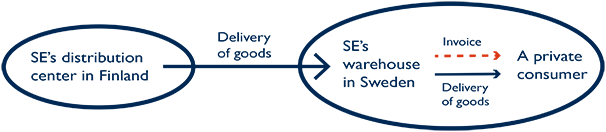

Example 6: Delivery of goods to a warehouse

A Finnish company FI belongs to a group of companies. The group has central warehouses in Germany, Italy and Spain. FI delivers goods to a warehouse in Germany. FI invoices the group whose VAT number is on the invoice. The country of destination is declared as DE and the VAT number of the trading partner is the German VAT number of the recipient of the goods. The transaction code is 11.

Example 7: Online store

A company DE sells a product to a private consumer in Germany. The product has been purchased from a Finnish company FI. A private consumer makes a purchase in the company's DE online store. A Finnish company FI sells the goods to DE and delivers the goods directly to the private person in Germany. FI submits an Intrastat declaration for dispatches, where the destination country is DE and the trading partner's QN999999999999. The nature of transaction is 11 because it is a trade between two companies.

NB: The transaction code 12 is only used in direct trade with a private person.

Example 8: A Finnish company buys goods from a Swedish private consumer who sends the goods to the company in Finland. FI is a data provider for arrivals. FI submits an Intrastat declaration for arrivals using transaction code 12. (valid until August 14, 2026)

Transactions where code 12 should not be used

Example 9: A private consumer in Germany makes a purchase from an online store of a German reseller DE. The German reseller DE orders goods from a Finnish company FI which sends the goods directly to the German private consumer. However, FI invoices the German reseller DE. FI submits an Intrastat declaration for dispatches, where the destination country is Germany DE.

The transaction code is 11, since the trade in question is between two companies. The trading partner’s VAT number in the dispatch declaration is the VAT number of the German company.

Example 10: A private consumer in Sweden buys goods from a Swedish company’s SE online store. The Swedish company has a distribution centre in Finland. The goods are delivered from a distribution centre to a warehouse in Sweden, and then to the buyer. This is not considered as a direct sale to a private consumer; instead, the goods movement is classified as a warehouse transfer. The transaction code is 31 or 32, and the trading partner’s VAT number in the declaration for dispatches is the VAT number of the Swedish company.

In the VAT number of the trading partner, the destination country must be the same, except in following special cases:

- The goods are delivered to a private person (QN999999999999):

Eg. A Finnish company FI sells goods to a private person in Germany. The goods are delivered to Germany. - An unknown trading partner (QV999999999999):

The trading partner is unknown for some other reason or the VAT-number is not known. Eg. A Finnish company FI delivers their own goods into a warehouse in Sweden. FI does not have a VAT number in Sweden. - The VAT number is greek (EL):

If the VAT number of the trading partner is Greek, the country code is EL. The country of destination is yet GR. - Tringular trade:

Triangulation refers to an arrangement where goods are sold twice consecutively so that all parties to the transaction are companies registered for VAT in the respective Member States.

In triangular trade the VAT identification number of the actual receiver of the goods is used first, if known. If the VAT number of the actual receiver of the goods is not known, the VAT number of the trading partner is exceptionally used according to the invoice the country code + 999999999999.

Eg. A Finnish company sells goods to an Austrian company AT, which sells them on to a German company DE. The goods are delivered directly from Finland to Germany. The Finnish company submits an Intrastat declaration for export. The country of destination is DE.

a.If the VAT identification number of the actual receiver of the goods is known, the VAT identification number of the German DE will be used in the declaration.

b. If the VAT identification number of the actual receiver of the goods is not known, the VAT identification number of the trading partner is exceptionally used according to the invoice AT999999999999.

The commodity code according to the Combined Nomenclature (CN classification). The CN classification covers the first eight numbers of the Finnish Customs Tariff Nomenclature (TARIC). If needed, the CN code can be copied to the form from the nomenclature in the programme. The CN can also be obtained from the Finnish Customs website Combined Nomenclature CN. The Customs Information Service provides instructions for defining commodity codes.

The programmes check whether the commodity code is valid. It is thus impossible to declare faulty commodity codes.

The country of destination for dispatches refers to the Member State to which the goods are intended to be exported from Finland and which is last known at the time of export. Loading goods from e.g. a truck to a ship does not change the country of destination.

The country where the goods were produced or manufactured is considered the country of origin. If the goods were manufactured in two countries or more, the country in which the last significant and financially justified manufacturing or processing took place shall be considered the country of origin.

For goods manufactured in Finland, the country of origin is Finland (FI).

If it is impossible to determine the country of origin of the goods, country of consignment is marked down as country of origin, Finland (FI).

For goods manufactured under contract or goods returned after repair work in Finland, the country of origin is Finland (FI).

The country of origin of goods returned from Finland is Finland (FI) if the nature of transaction is 21.

For used vessels and aircraft in Finnish ownership, Finland (FI) is declared as the country of origin for dispatches (see also Statistical data on vessels and aircraft).

The data shall be declared using two-letter country codes according to Eurostat’s GEONOM-classification.

The nature of the transaction is declared using the two-digit codes.

The nature of transaction code is used to describe different types of goods deliveries. The code indicates, for example, if there are any changes in the ownership of the goods, if there is a trade invoice related to the goods, if the goods are processed or repaired. For example, code 11 is used to indicate a purchase or sale between two businesses (B2B) where the ownership of the goods is changed in return for compensation.

If a private consumer in Denmark buys goods from an online store of a Finnish company (FI), FI invoices the Danish person and delivers the goods to him or her from Finland to Denmark (dispatch). The nature of this transaction is 12.

More information about different types of goods deliveries is on the website What data is declared in Intrastat.

Codes are used in comparing values provided on a statistical declaration and on a value added tax declaration.

The mode of transport is defined according to the active means of transport with which the goods are exported across the Finnish border. If the mode of transport is unknown, the most likely mode of transport shall be declared.

The 1-digit code indicating the mode of transport shall be declared as follows:

1 Sea transport (including car ferry and train ferry transport)

2 Rail transport

3 Road transport (only possible at the Finnish and Swedish land border)

4 Air transport

5 Postal consignments

7 Stationary modes of transport (pipe, cable, electric cable)

8 Inland water transport (the Saimaa canal)

9 Own propulsion (for example watercraft and aircraft)

Example 1

A Finnish company sells goods to Germany. At the Finnish company´s warehouse the goods are loaded to a lorry, which is driven to Helsinki. The lorry is moved aboard a ship and the ship sales to Travemünde.

The active means of transport when crossing the Finnish border is the ship, thus the mode of transport is 1 (sea transport).

Example 2

A Finnish company sells a truck to Sweden. The company’s driver drives the vehicle from Finland to Sweden.

Code 9 (own propulsion) is given as the mode of transport.

The pure net mass of the goods item in kilograms (kg). Net mass refers to the weight of the goods without wrapping or packaging.

The quantity must always be declared as an integer, without decimals and without separating full stops or commas. For example, 0.5 kg is declared as 1. Net mass can also be 0, for example 0.1 kg is declared 0 kg.

Net mass must be declared for all commodity codes except for the ones with a supplementary unit. The application notifies declarants if the net mass does not need to be declared for the commodity code. There is a list of these commodity codes on the Finnish Customs website Combined Nomenclature CN. As for commodity codes for which it is optional to declare net mass, the field is either left empty, or the actual net weight is entered.

Declare the supplementary unit (e.g. liter, piece, pair, m2, m3) only if it is mandatory for the relevant CN code. You can check the required quantity unit in the “Supplementary unit” column of the Combined Nomenclature.

Please note:

- Always report the quantity as a whole number without decimals. Example: 45,3 m2 is reported as 45 m2.

- The supplementary unit must always be at least one (1).

- If the goods are packed in retail sale packages containing several items, report the total number of individual items (See instructions under NAR).

- If a supplementary unit is mandatory for a CN code, you do not need to report the net weight. However, if you do report it, use the total weight of the products.

More information:

- List of quantity units in use Quantity units

- List of CN codes for which the supplementary unit is mandatory Combined Nomenclature CN

Examples of reporting the supplementary unit:

GRM, gram

A company exports 24 silver necklaces (CN 7113 11 00) with a 45 cm long chain and a small pendant. One necklace weighs 17 grams.

Supplementary unit: 408 GRM (24 x 17 g = 408 g)

Note: In this case, the net weight is 0 kg.

KGE, drained net mass in kilograms

Drained net weight refers to the weight of the product contained in the package, without liquid, etc.

A company exports 50 cans of olives (CN 0709 92 90). One can weighs 235 g and contains 142 g olives.

Supplementary unit: 7 KGE (50 x 142 g = 7100 g or 7,1 kg)

Note: The supplementary unit (KGE) cannot exceed the net weight (KG).

LPA, liter pure (100 %) alcohol (strength x liters divided with 100)

A company exports 50 half-liter (0,5 l) bottles of liquor (CN 2208 70 10) with an alcohol content of 21% by volume. The total amount is 25 l (50 pc x 0,5 l = 25 l).

Supplementary unit: 5 LPA (21 x 25 l : 100 = 5,25)

MIL, 1000 pieces

A company exports 3000 eggs (CN 0407 21 00).

Supplementary unit: 3 MIL (3000 pcs : 1000 = 3)

MTK, square meter, m2 (length x width)

A company exports 50 wool carpets (CN 5703 10 00). The size of one carpet is 150 x 200 centimeters.

Supplementary unit: 150 MTK (50 x 1,5 m x 2 m = 150 m2)

MTQ, cubic meter, m3 (length x width x height)

A company exports peeled saw pine logs (CN 4403 21 10). The logs are 2 meters long, the stack is 1,5 meters wide and 3 meters high.

Supplementary unit: 9 MTQ (2 m x 1,5 m x 3 m = 9 m3)

NAR, piece

A company exports 20 retail sale packages, each containing five CDs (CN 8523 49 20).

Supplementary unit: 100 NAR (20 x 5 pcs = 100)

NPR, number of pairs

A company exports 100 pairs of wooden shoes (CN 6405 20 10).

Supplementary unit: 100 NPR

The invoice value is always declared as an integer, without decimals (whole euros, no cents) for example 750,45 € is declared as 750 €. The invoice value can never be zero (0) or a negative number.

Discounts granted in the invoice may be deducted in full when declaring the invoice value.

The invoice value for dispatches is the tax free selling price of the goods according to the invoice, which includes all additions to the price that the seller charges the buyer. If the seller charges the buyer with expenses caused by the delivery of the goods, these shall be included in the invoice value.

Example 1

A Finnish company FI sells a machine to a Swedish company SE. FI sends an invoice for 51 000 euros to SE. The invoice includes the delivery costs from Finland to Sweden.

In the Intrastat declaration, the invoice value of the machine is 51 000 euros.

Example 2

A Finnish company FI sells a machine to a Swedish company SE. FI sends an invoice for 50 000 euros to SE. The machine is delivered from Finland to Sweden by a transport company, who send an invoice for 1 000 euros to SE.

In the Intrastat declaration, the invoice value of the machine is 50 000 euros.

The invoice value of standard software saved in a data medium shall be the total value of the data medium and the software according to the invoice.

For goods supplied free of charge, the price which would be invoiced for the goods in the event of a normal sale (dispatches) shall be declared as the invoice value.

The invoice value of goods delivered for manufacturing under contract or repair work shall be the value of the goods at the time of delivery. Concerning goods supplied free of charge, the current value is reported. When the goods are returned after the manufacturing or repair work, the invoice value shall be the value of the goods plus the work expenses and other such extra costs according to the invoice.

The invoice value of goods for renting or leasing shall be the value of the goods, not the rent or other compensation to be paid.

Declaring the statistical value is optional, and if it is declared, it must be determined correctly.

The statistical value is declared as an integer, without decimals (whole euros, no cents) for example 750,45 € is declared as 750 €. The statistical value can never be zero (0) or a negative number.

Discounts granted in the invoice may be deducted in full when declaring the statistical value.

The statistical value of standard software saved in a data medium should be the total value of the data medium and the software at the Finnish border, according to the invoice.

For dispatches, the tax free selling price of the good is used as statistical value. Freight and insurance costs for the goods up to the place of exportation at the Finnish border shall be included in the statistical value (FOB value). In the example below, delivery costs C are included in the statistical value for dispatches, but not delivery costs D.

The statistical value of goods supplied entirely or partly free of charge is defined according to the price that would be charged for the goods in the event of normal sale from Finland (dispatches).

The statistical value of goods delivered for manufacturing under contract or repair work should be the value of the goods at the Finnish border. When the goods are returned after the manufacturing or repair work, the statistical value shall be the value of the goods plus the work expenses and other such extra costs according to the invoice, as well as freight and insurance costs up to the Finnish border.

The statistical value of goods for renting or leasing should be the value of the goods at the Finnish border at the time of delivery, not the rent or other compensation to be paid.