Example: Arrivals (valid until August 14, 2026)

A Finnish company FI purchases goods from a Swedish company SE, which delivers the goods to FI in Finland (B2B).

- FI submits an Intrastat declaration for arrivals. The nature of transaction is 11.

Example: Dispatches

A Finnish company FI sells and delivers goods to a Swedish company SE in Sweden.

- FI submits an Intrastat declaration for dispatches. The nature of transaction is 11.

Example: Arrivals (valid until August 14, 2026)

A Finnish company FI purchases goods from a Swedish private individual, who delivers the goods to FI in Finland (C2B).

- FI submits an Intrastat declaration for arrivals. The nature of transaction is 12.

Note: If a private consumer buys a product from a foreign online store, which a foreign company invoices and delivers directly to the private consumer in Finland, Intrastat declaration for arrivals is not to be submitted, as the obligation applies only to companies.

Example: Dispatches

A Finnish company FI sells and delivers goods to a private individual in Sweden.

- FI submits an Intrastat declaration for dispatches. The nature of transaction is 12.

Example: Arrivals (valid until August 14, 2026)

A Finnish company FI has sold a product to a Swedish company SE. SE makes a complaint about the damaged product and returns it to FI in Finland.

- FI submits an Intrastat declaration for arrivals. The nature of transaction is 21.

Example: Dispatches

A Finnish company FI has purchased a product from a Swedish company SE. FI makes a complaint about the damaged product and returns it to SE in Sweden.

- FI submits an Intrastat declaration for dispatches regarding the returned goods. The nature of transaction is 21.

Example: Arrivals (valid until August 14, 2026)

A Finnish company (FI) has purchased a product from a Swedish company SE. FI makes a complaint about the damaged product and returns it to SE in Sweden. SE sends a replacement product to FI in Finland.

- FI submits an Intrastat declaration for arrivals regarding the replacement product. The nature of transaction is 22.

Example: Dispatches

A Finnish company FI has sold a product to a Swedish company SE. SE makes a complaint about the damaged product and returns it to FI in Finland. FI sends a replacement product to SE in Sweden.

- FI submits an Intrastat declaration for dispatches regarding the replacement product. The nature of transaction is 22.

Example: Arrivals (valid until August 14, 2026)

A Finnish company FI has purchased a product from a Swedish company SE. FI makes a complaint because the product is broken. The product cannot be repaired, so FI does not return it to the Swedish company. SE sends a replacement product to FI in Finland.

- FI submits an Intrastat declaration for arrivals regarding the replacement product. The nature of transaction is 23.

Example: Dispatches

A Finnish company FI has sold a product to a Swedish company SE. The Swedish company SE makes a complaint because the product is broken. The product cannot be repaired, so SE does not return it to the Finnish company. FI sends a replacement product to SE in Sweden.

- FI submits an Intrastat declaration for dispatches regarding the replacement product. The nature of transaction is 23.

3. Transactions involving intended change of ownership or change of ownership without financial compensation

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE has a warehouse in Finland, from which goods are sold to multiple Finnish buyers. The Swedish company is registered for VAT in Finland and has a Finnish VAT number.

- The Swedish company submits an Intrastat declaration for arrivals regarding the goods brought into the warehouse, using its Finnish VAT number. The nature of transaction is 31.

Example: Dispatches

A Finnish company FI has a warehouse in Sweden, from which goods are sold to multiple Swedish buyers. The Finnish company is registered for VAT in Sweden and has a Swedish VAT number.

- FI submits Intrastat declarations for dispatches regarding the goods sent to the warehouse. The nature of transaction is 31 and the VAT-number of the trading partner is the FI´s Swedish VAT-number.

Nature of transaction 32 covers two purposes:

1. Delivery of goods for sale after approval or trial

This refers to a situation where goods are delivered to a potential buyer located in the destination country. The recipient tests, examines the product and, upon approval, agrees to purchase the goods from the seller.

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE sends products to a Finnish company FI for testing before the purchase decision. FI approves the products and concludes the purchase with SE.

- FI submits an Intrastat declaration for arrivals regarding the delivery of goods. The nature of transaction is 32.

Example: Dispatches

A Finnish company FI sends products to a Swedish company SE for trial before the purchase decision. SE approves the products and concludes the purchase with FI.

- FI submits an Intrastat declaration for dispatches regarding the delivery of goods. The nature of transaction is 32.

2. Delivery of goods to consignment and call-off stock

A call-off stock refers to a warehouse where a known buyer has the right to take ownership of the goods at a later time. The goods are transferred to another EU country to a warehouse managed by the buyer or a third party.

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE sells goods to a Finnish company FI. The goods are delivered from Sweden to a warehouse located at FI’s premises in Finland. FI uses the goods according to its business needs. FI issues a monthly invoice to SE based on the quantity of goods withdrawn from the warehouse. The warehouse is not staffed by SE, and it contains only goods intended for sale to FI.

- FI submits Intrastat declarations for arrivals based on the deliveries. The nature of transaction is 32.

Example: Dispatches

A Finnish company FI sells goods to a Swedish company SE. The goods are delivered from Finland to a warehouse located at SE’s premises in Sweden. SE uses the goods according to its business needs. SE issues a monthly invoice to FI based on the quantity of goods withdrawn from the warehouse. The warehouse is not staffed by FI, and it contains only goods intended for sale to SE.

- FI submits Intrastat declarations for dispatches based on the deliveries. The nature of transaction is 32.

Financial leasing (sales leasing) is a specific type of leasing agreement aimed at the transfer of ownership of the goods. The lease payments are calculated to cover the full or nearly full value of the goods. Ownership of the goods, along with the related benefits and risks, typically transfers to the lessee at the end of the lease term.

Example: Arrivals (valid until August 14, 2026)

A Finnish company FI enters into a leasing agreement for a car with a Swedish company SE. SE delivers the car to Finland.

- FI submits an Intrastat declaration for arrivals regarding the car. The nature of transaction is 33.

Delivery of goods where ownership is transferred without any monetary compensation. If the recipient of the goods pays or had paid for the goods at any point, code 34 cannot be used.

Nature of transaction 34 includes two types of transactions:

1. Free goods

Ownership of the goods is transferred without any monetary or other compensation. No payment is made in advance, at the time of delivery, or afterwards. The goods are not invoiced at all.

Example: Dispatches

A Finnish company manufacturing fire trucks sends a demonstration vehicle as a gift to a volunteer fire brigade in another EU Member State for forest fire prevention.

- FI submits an Intrastat declaration for dispatches. The nature of transaction is 34.

2. Barter trade

In barter trade, ownership of goods is transferred, and both parties receive material compensation without any payment. Barter is therefore a direct exchange of goods, where the consideration is received in the form of goods instead of monetary payment.

Example: Arrivals (valid until August 14, 2026) and Dispatches

A Finnish company FI provides goods free of charge to its Swedish business partner SE. In return, SE provides its own product free of charge to FI.

- FI submits an Intrastat declaration for dispatches for the goods it sends, and an Intrastat declaration for arrivals for the goods it receives. The nature of transaction for both directions (arrivals and dispatches) is 34.

Contract-based processing (toll manufacturing, processing) covers activities aimed at producing a new or significantly improved product, such as transformation, construction, assembly, repair, and refurbishment. As a result of processing, the product's commodity code (CN8) often changes. During the processing, ownership of the goods does not change.

If a company’s line of business involves the manufacture of products and the company purchases raw materials etc. for that purpose, the transaction is considered a regular acquisition rather than contract-based processing. In such cases, the nature of transaction is 11.

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE sends fabric to a Finnish company FI in Finland for processing. FI delivers the finished products back to Sweden after processing.

- FI submits an Intrastat declaration for arrivals regarding the fabric. The nature of transaction is 41.

Example: Dispatches

A Finnish company FI sends fabric to an Estonian company EE for processing. EE delivers the finished products back to Finland after processing.

- FI submits an Intrastat declaration for dispatches regarding the fabric. The nature of transaction is 41.

Contract-based processing (toll manufacturing, processing) covers activities aimed at producing a new or significantly improved product, such as transformation, construction, assembly, repair, and refurbishment. As a result of processing, the product's commodity code (CN8) often changes. During the processing, ownership of the goods does not change.

If a company’s line of business involves the manufacture of products and the company purchases raw materials etc. for that purpose, the transaction is considered a regular acquisition rather than contract-based processing. In such cases, the nature of transaction is 11.

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE delivers fabric to a Finnish company FI for processing in Finland. The finished products are not delivered back to Sweden.

- FI submits an Intrastat declaration for arrivals regarding the fabric. The nature of transaction is 42.

Example: Dispatches

A Finnish company FI delivers fabric to an Estonian company EE for processing in Estonia. The finished products are not delivered back to Finland; EE delivers them to Spain.

- FI submits an Intrastat declaration for dispatches regarding the fabric. The nature of transaction is 42.

Contract-based processing (toll manufacturing, processing) covers activities aimed at producing a new or significantly improved product, such as transformation, construction, assembly, repair, and refurbishment. As a result of processing, the product's commodity code (CN8) often changes. During the processing, ownership of the goods does not change.

If a company’s line of business involves the manufacture of products and the company purchases raw materials or similar items for that purpose, the transaction is considered a regular acquisition rather than contract-based processing. In such cases, the nature of transaction is 11.

Example: Arrivals (valid until August 14, 2026)

A Finnish company FI has delivered juice concentrate to an Estonian company EE, which produces a beverage from the concentrate and bottles it. The finished products are delivered back to Finland after processing.

- FI submits an Intrastat declaration for arrivals regarding the finished products. The nature of transaction is 51.

Example: Dispatches

A Swedish company SE has delivered wood to a Finnish company FI for processing in Finland. FI delivers the finished products back to Sweden after processing.

- FI submits an Intrastat declaration for dispatches regarding the finished products. The nature of transaction is 51.

Contract-based processing (toll manufacturing, processing) covers activities aimed at producing a new or significantly improved product, such as transformation, construction, assembly, repair, and refurbishment. As a result of processing, the product's commodity code (CN8) often changes. During the processing, ownership of the goods does not change.

If a company’s line of business involves the manufacture of products and the company purchases raw materials or similar items for that purpose, the transaction is considered a regular acquisition rather than contract-based processing. In such cases, the nature of transaction is 11.

Example: Dispatches

A Swedish company SE has delivered fabric to a Finnish company FI for processing in Finland. The finished products are not delivered back to Sweden; FI delivers them to Denmark.

- FI submits an Intrastat declaration for dispatches regarding the finished products. The nature of transaction is 52.

Repair refers to restoring a product to its original usable condition, such as maintenance or improvement work, where the nature of the product does not change in any way. During the repair process, the ownership of the goods does not change, nor does the commodity code (CN8). The code used in arrivals and dispatches is 60.

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE sends a damaged product to Finland for repair by a Finnish company FI, from which the product was originally purchased.

- FI submits an Intrastat declaration for arrivals regarding the damaged product. The nature of transaction is 60.

Example: Dispatches

FI sends the repaired product back to Sweden.

- FI submits an Intrastat declaration for dispatches regarding the repaired product. The nature of transaction is 60.

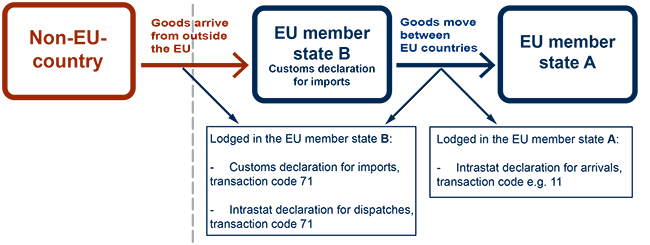

7. Transactions with a view to customs clearance / post-customs clearance transactions (not involving change of ownership, related to goods in quasi-arrivals or quasi-dispatches)

Quasi-imports and quasi-exports are rare, and codes 71 and 72 are used only in exceptional cases. Regular imports or exports do not fall under this category. Quasi-trade is not considered actual trade for the Member State through which the goods pass, and therefore it should be identified and attributed to the correct Member State in statistics. The nature of transactions 71 and 72 serve as one method of identifying quasi-trade in both customs data and intra-EU trade statistics.

Example if Member State B is Finland:

Goods are imported from outside the EU to Finland, where they are customs cleared and released for free circulation.

- An import declaration is submitted In Finland. The nature of transaction is 71.

- An Intrastat declaration for dispatches is also submitted in Finland. The nature of transaction is 71.

Example if Member State A is Finland:

Goods are imported to Finland from another Member State, where they have been customs cleared and released for free circulation.

- An Intrastat declaration for arrivals is submitted in Finland. The nature of transaction is for example, 11. (valid until August 14, 2026)

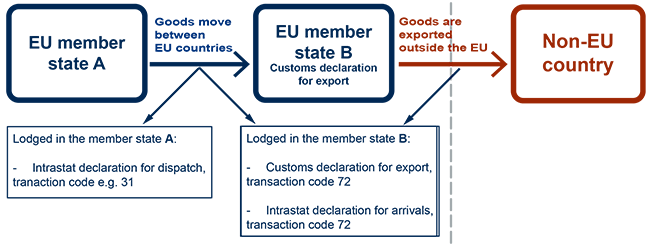

Quasi-imports and quasi-exports are rare, and codes 71 and 72 are used only in exceptional cases. Regular imports or exports do not fall under this category. Quasi-trade is not considered actual trade for the Member State through which the goods pass, and therefore it should be identified and attributed to the correct Member State in statistics. The nature of transaction codes 71 and 72 serve as one method of identifying quasi-trade in both customs data and intra-EU trade statistics.

Example if Member State A is Finland:

Goods are exported from Finland to another Member State, and they are placed under the export procedure in Finland.

- An Intrastat declaration for dispatches is submitted in Finland. The nature of transaction should be, for example, 31 or 99.

- Code 72 must not be used.

Example if Member State B is Finland:

Goods are imported from another Member State to Finland, where they are placed under the export procedure.

- An export declaration is submitted in Finland. The nature of transaction is 72.

- An Intrastat declaration for dispatches is submitted In Finland. The nature of transaction is 72. (valid until August 14, 2026)

8. Supply of building materials and technical equipment when all goods of the contract are invoiced with a single invoice

Example: Arrivals (valid until August 14, 2026)

A Swedish company SE enters into an agreement with a Finnish company FI for the construction of a production line. The agreement includes deliveries of goods to Finland over a six-month period, as well as assembly and testing of the line's functionality. SE invoices the entire project in a single instalment after the testing has been approved.

- FI submits an Intrastat declaration for arrivals based on the invoice issued by SE. The nature of transaction is 80.

Example: Dispatches

A Finnish company FI enters into an agreement with a Swedish company SE for the construction of a production line. The agreement includes deliveries of goods to Sweden over a six-month period, as well as assembly and testing of the line's functionality. FI invoices the entire project in a single instalment after the testing has been approved.

- FI submits an Intrastat declaration for dispatches based on its invoice. The nature of transaction is 80.

Example: Arrivals (valid until August 14, 2026)

A Finnish company FI rents a measuring device from a Swedish company SE for a three-year period. SE delivers the device to Finland.

- FI submits an Intrastat declaration for arrivals. The nature of transaction is 91.

Example: Dispatches

A Finnish company FI rents a measuring device to a Swedish company SE for a three-year period. FI delivers the device to Sweden.

- FI submits an Intrastat declaration for dispatches. The nature of transaction is 91.

This category includes transactions that do not involve an actual, anticipated, or intended future transfer of ownership, and which cannot be classified under other nature of transaction codes.

Example: Arrivals (valid until August 14, 2026)

1. A Finnish company FI imports its own fixed assets from Sweden to Finland. Ownership of the goods doesn’t change.

- FI submits an Intrastat declaration for arrivals. The nature of transaction is 99.

2. A Swedish company SE has made an agreement with a Finnish company FI for the disposal of waste. SE delivers the waste to Finland for processing at a waste treatment facility. SE pays FI for the service (waste processing).

- FI submits an Intrastat declaration for arrivals. The nature of transaction is 99.

Example: Dispatches

1. A Finnish company FI sends its fixed assets from Finland to Sweden. The ownership of the goods doesn’t change.

- FI submits an Intrastat declaration for dispatches. The nature of transaction is 99.

2. A Finnish company FI has made an agreement with a Swedish company SE for testing material it has manufactured. FI sends the material to Sweden and pays SE for the testing. Nothing is returned to Finland after the testing, and any remaining material is disposed of.

- FI submits an Intrastat declaration for dispatches. The nature of transaction is 99.