Dispatches to warehouses

Dispatches to warehouses, excluding consignment stock or call-off stock

Dispatches to warehouse refers a situation where a company transfers its own goods for storage in a warehouse in another EU country. The transfer is primarily for logistical reasons. Typically, the warehouse located abroad is managed by a logistics service provider. The intention is to sell the goods transferred into storage, but the sale has not yet taken place, but the sale has not yet taken place. The buyers of the goods are not yet known, nor to which country the goods will eventually be exported.

When a company registered for VAT in Finland dispatches goods to another EU member state, and the goods are to be placed in storage in that country for sale, further delivery or some other purpose, the goods must be declared by submitting an Intrastat declaration on dispatches in Finland.

A Finnish export company delivering stock goods to its own warehouse located in another Community country usually has to register for VAT in the country in question and submit a statistical declaration on the goods transfer both in Finland and in the Country of destination in question (in Finland = dispatches; in the Country of destination = arrivals).

Transaction code 31 is used to refer to the above storage transfers. The value of the goods at the time of the delivery shall be entered as the value.

If a Finnish company delivers goods to a warehouse located in another EU member state, the trading partner’s VAT number is the company’s own foreign VAT number if the company is registered for VAT in the country of destination. The company owns the exported goods and imports them to another EU member state.If the Finnish company does not have a VAT number of the destination country, the VAT number of the trading partner is declared as QV999999999999.

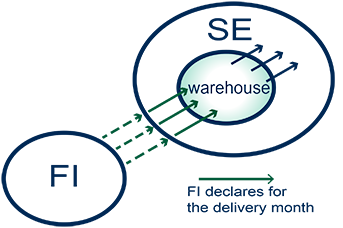

For example: A Finnish company delivers goods to its sales warehouse in Sweden, from where the goods are further sold to different customers in Sweden. The Finnish company is registered for VAT in Sweden and FI makes Intrastat declarations for the imported goods. The code of transaction code is 31.

Dispatches to consignment stock and call-off stock

Call-off stock refers to a storage facility located in the premises of a previously known buyer of goods from where goods are delivered exclusively to the sole buyer in question. The seller transfers goods to a storage facility located in another EU country for delivery to a particular buyer. Right of ownership is not yet transferred at the stage of dispatch. The buyer takes on ownership of the goods only after they remove the goods from storage.

When a company registered for VAT in Finland exports goods to another EU member state, and the goods are to be placed into call off stock in that country, the goods must be declared by submitting an export Intrastat declaration in Finland. In storage transfers of this type, the transaction type is reported with the code 32. The value of the goods at the time of the delivery is entered as the invoice value.

The VAT number of the trading partner is that of the consignee based in another EU member state in whose facilities the call-off stock is located, and who subsequently buys the goods after taking them into use.

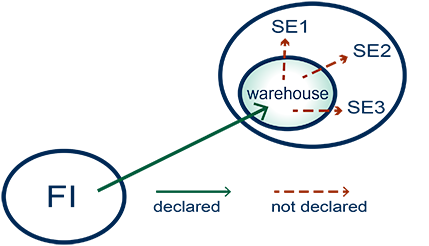

For example: A Finnish company sells goods to a Swedish company, goods that are delivered from Finland to a warehouse located on the Swedish company´s premises. SE uses the goods in its business when needed. FI invoices SE monthly according to the quantity taken from the warehouse. There are no personnel under FI's control in the warehouse and there are only goods for sale to SE. FI makes an Intrastat declaration for arrivals according to deliveries. The code of transaction is 32.